NBN Co has finally revealed how it might implement ‘flat’ wholesale prices, but it would involve a $5 to $20 a month hike, and as-yet unquantifiable yearly increases above the rate of inflation.

The company on Monday morning opened a “pre-lodgement” consultation with retail service providers, canvassing views on effectively two flat-price models.

The models axe the variable connectivity virtual circuit (CVC) charge, either for 100Mbps and above products, or for all products.

But analysis by iTnews shows they are subject to a complex mix of assumptions and cost-recovery models - and not even NBN Co executives would put a number range on what they might mean for retail prices in the long-term.

NBN Co has been under sustained pressure from retail service providers (RSPs) to kill the CVC construct, which sees RSPs pay variable excess charges based on user consumption of internet services.

RSPs want to pay a simple, flat wholesale price per NBN service, regardless of how the service is used.

NBN Co’s issue with that is it recovers some of its costs through excess CVC charges, and needs to find other ways to bring in that revenue if CVC as a construct ceases to exist.

So, the proposed flat price structure is flat, to a point: RSPs won’t face variation in their NBN bandwidth bills every month, but they will face yearly hikes of presently unknown quantum.

That uncertainty will make it difficult, at least now, to model whether the flat price models are workable.

Pricing breakdown

The first thing to note about the new price models is that customers will pay more for broadband off-the-bat.

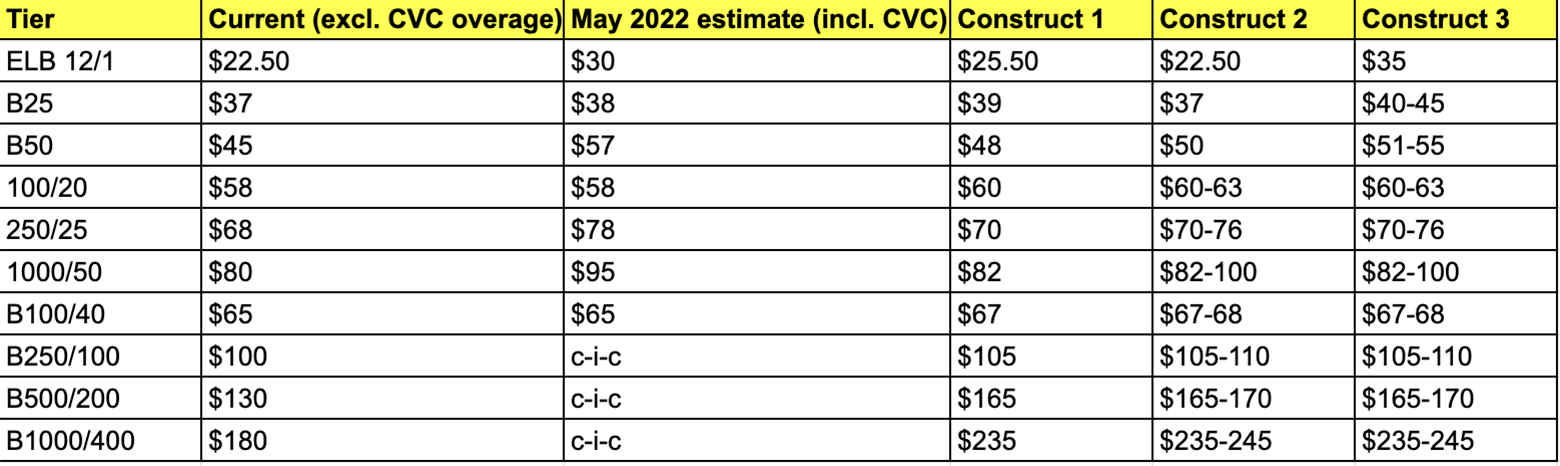

For readability and comparative purposes, iTnews has compiled below what the immediate price hikes would look like - these are all wholesale (not retail) but one could safely assume RSPs would pass these on.

It’s also important for some quick definitions of the three new constructs that NBN Co is proposing:

- Construct 1: Roughly same model as now - bundled products, but with CVC charged at $6/Mbps instead of $8/Mbps

- Construct 2: Regular bundles for 50Mbps and below, with $5/month increase for 50Mbps. Flat pricing only for products 100Mbps and above, with immediate $5-20/month hike, and yearly indexed increases.

- Construct 3: Flat pricing for all tiers, with immediate $5-20/month hike, and yearly indexed increases.

The two flat-price options - Constructs 2 and 3 - differ on where the flat-pricing comes in.

This is because NBN Co argues that under a flat-pricing model, it would have to substantially hike the price of lower-end services.

There are some key assumptions at play here.

First, the price increases are based on the assumption that by the time one of these models is approved, “average CVC provisioning per service in operation (SIO) across all services [will be] 3Mbps.”

Second, low-end pricing in Construct 3 embeds an expected loss of customers that NBN Co anticipates will occur.

“NBN Co estimates that between 69,000 to 170,000 end-users would no longer be able to afford or be willing to take-up nbn broadband under Construct 3, primarily as a result of the removal of data-capped plans in market and retail price increases,” it said in a consultation paper

“The initial pricing proposal under Construct 3 has been adjusted to account for potential losses in NBN take-up.”

Indexed increases

The major unknown in NBN Co’s proposal is that it anticipates yearly cost increases to counteract the loss of CVC revenue, but doesn’t spell out what this might look like.

These yearly increases consist of inflation plus an unknown additional percentage.

“Where pricing proposals ... restrict or entirely remove NBN Co’s ability to recover its costs through usage-based charges in the form of CVC as applied to increasing bandwidth usage, NBN Co should have the opportunity to recover those costs by increasing fixed charge pricing components in real terms (i.e. an increase above the rate of inflation, reflecting the rapid growth in usage and hence capacity),” the company said.

“This is critical to allowing NBN Co the opportunity to generate additional revenue to recover efficient existing and future investments needed to sustain growing bandwidth requirements as well as network upgrade programs to uplift the capability of the network.”

NBN Co denied that the index was simply a way to hide the CVC charge; in other words, a continuation of CVC by another name.

“It’s not a substitute for CVC in the sense that CVC would be removed and that revenue stream is just moved to that adjustment mechanism,” NBN Co’s executive general manager for commercial Ken Walliss told iTnews.

Chief legal and regulatory officer Jane van Beelen told iTnews that RSPs would have more “certainty” over pricing in the new model, since the indexed increases are yearly and the way they were calculated would be baked into the special access undertaking (SAU).

“The important thing is it would provide certainty because we’re proposing to lock this index into the SAU so the concern that the retailers have about CVC is that it translates as cost uncertainty from month-to-month that they have to then manage operationally and it also means it’s hard for them to have a long-term view for the price path,” she said.

“By locking this index into the SAU that would really give them locked-in, long-term price path certainty.”

Van Beelen said NBN Co could not put a range on the yearly increase until RSPs chose their desired model, though it remained unclear why this was the case.

“It’s very difficult to put a number on that until we settle on what the price construct is,” she told iTnews.

“I think what we’d need to do is conduct the consultation but we hope we’ve given an indication that there would need to be an indexation of prices annually but we’re prepared to commit to that rate to basically bind ourselves in order to provide the certainty that RSPs are seeking.”

Discounting remains

NBN Co is also hoping to retain its ability to offer short-term discounts, despite the unpopularity of that model among RSPs.

"NBN Co considers that its ability to offer discounts in certain situations remains an important part of its overall approach to pricing, and leads to more efficient pricing outcomes," the company said.

"Discounts allow nbn to provide targeted incentives to RSPs to ensure efficient take-up of services by end users.

"They also allow NBN Co to determine whether price changes will achieve their intended outcomes, without being exposed to unacceptable long-term commercial risk.

"If NBN Co were not able to employ discounts, we would be less likely to test and then offer, changes to our prices."

The pricing proposals are expected to be debated by RSPs at an ACCC-convened roundtable next week.

NBN Co hopes to use feedback from this process to draft a formal change to its SAU which it hopes to submit to the ACCC by the end of the year.

Stay tuned to iTnews for more on this developing story.